Bank Rakyat Financing-i ( Swasta ) for private sector |

|---|

| Enjoy as low as 4.95% p.a interest |

| No guarantor needed and quick approval |

| Available for private sector and selected GLCs |

| Maximum RM 150,000 financing available ( 25 times salary) |

| Minimum RM 1,000 of basic income |

| Maximum 10 years repayment period |

| Borrow up to 25 x your salary |

| Malaysian Citizens only |

Bank Rakyat Personal Financing-i Aslah Swasta is an Islamic compliant personal product that is catered for public sector and selected panel list of companies from private sector. The loan is based on Shariah, Tawarruq concept. Typically Bank Rakyat personal loan is popular among public sector however this package is specially catered for private sector. Although this loan is offered to private sector, it is meant for professionals such as lawyers, accountants, architects, engineers, doctors, employers of large public listed companies and also GLCs in Malaysia. Selected private companies will be able to enjoy better interest rates.

This loan is unsecured therefore no guarantor and collateral is needed. As compare to other loans in Malaysia, Financing-i Aslah gives much higher financing amount. You will be able to loan 15 times your gross salary if you earn RM 2,000 to RM 4,000 while 20 times your gross salary if you earn between RM 4,001 and RM 6,000. You can even loan up to 25 times if your salary is above RM 6,000. However this is only applicable to direct salary deduction with Biro Angkasa program. On the latest update , there are choices of non-salary deduction repayment however with very high interest rates. The financing amount offered is very high as private loans offered are usually 5 times amount the borrower’s salary.

The loan amount is also dependent on credit score such as CCRIS and CTOS. One of the perk of the loan is that you can have lower interest rate if you sign up with auto loan deduction from saving accounts. Lower interest rates can also be offered if you use Takaful insurance.

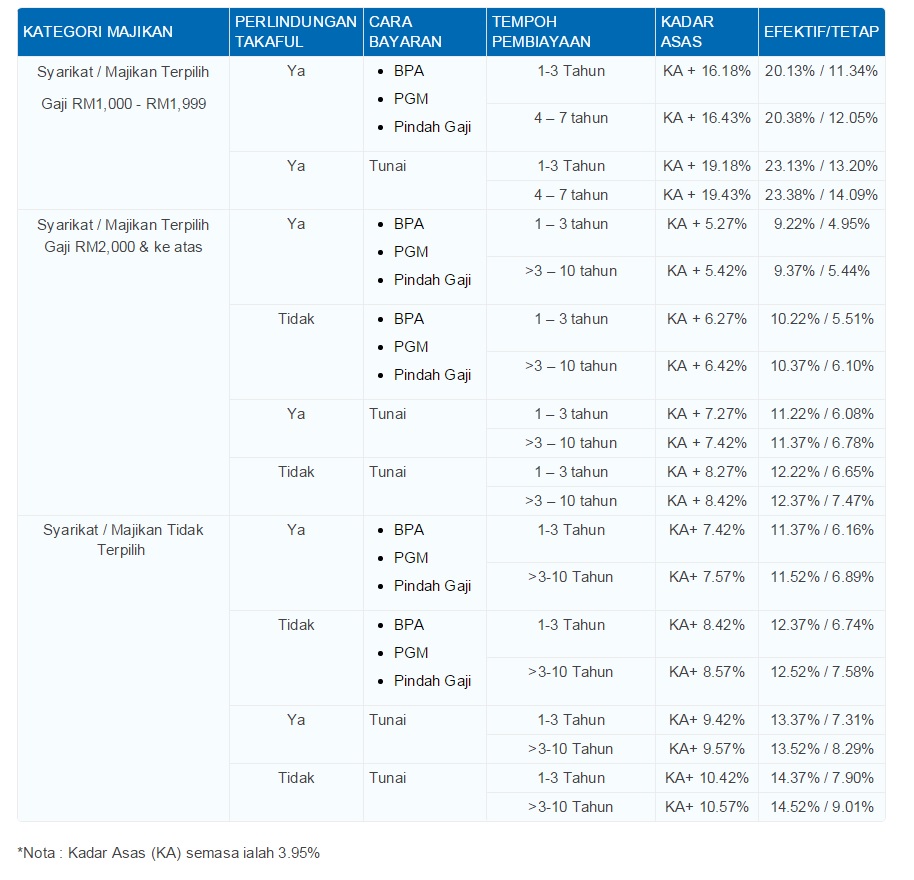

Interest Rates

Currently, this personal loan’s interest rates is on floating basis and it is tied up with Bank Rakyat’s Base Rate. There are huge difference of Interest rates given by Bank Rakyat. Applicants will be charged higher interest rates if they fall into lower salary bracket. Some actions such as opting for auto salary deduction (Biro Angkasa) scheme ,and buying Takaful Insurance will also save you some interest rates

Eligiblity

You will need to have a minimum salary of RM 1,000 in order to quality for the loan. This is considered one of the lowest salary requirements for a personal loan in Malaysia. You will also need to be a Malaysian citizen with EPF transaction for 6 months while aged between 18 years old and 60 by the end of financing tenure. This loan is only offered to private sectors from Bank Rakyat Panel List. Applicants will need to have a permanent employment with RM 1,000 as minimum salry while contract employees salary needs to be above RM 8,000.

Repayment

Borrower will have a few option for the repayment on the loan. This would be done through Bureau Angkasa program, direct salary deduction on employer side, salary transfer or cash.

Charges

Successful applicants will be charge 0.5% Stamp duty based on financing amount. There is also a RM 30 Wakalah fees. Any late payment will be subjected to 1% penalty. Early settlement is possible with extra repayment. Takaful Insurance is optional. All service charges may be subjected to 6% GST

Documents required

- Photocopy IC Front & back

- Most recent 3 months salary slip

- Employment letter

- Most recent annual EPF statement

- Income tax return form

Repayment Method

- Biro Angkasa deduction

- Cash

- Direct salary deduction at employer side

- Salary transfer to Bank Rakyat

Panel List of private companies

Panel Pekerja Swasta Bank Rakyat

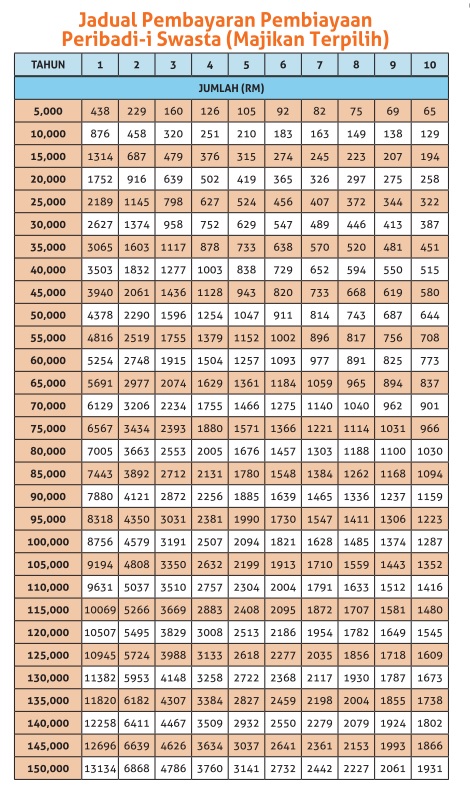

Repayment Table

What should you know about this loan ?

Bank Rakyat Personal Financing-i is one of the most popular personal loan in Malaysia. The interest rates offered are competitive if you are on the right bracket. However this loan is very limited to selected private panel companies. Please check whether your company is listed a panel before applying for the loan