| Bank Rakyat Financing-i Aslah Awam (Public) |

|---|

| No guarantor needed and immediate approval |

| Only available for government servants and GLC or public sector employee. |

| Maximum RM 150,000 financing |

| Minimum RM 1000 of basic income |

| Malaysian Citizens only |

| 10 years repayment |

| Optional Takaful in case of unfortunate events |

Bank Rakyat Personal Financing-i Aslah is a Shariah compliant personal loan package is that catered for Government servants and GLC staffs that is based on buy and sell concept. This loan requires no collateral and guarantor. The maximum financing amount for the loan would be a RM 200,000 or 35 times monthly salary with a maximum 10 years repayment period. As of all government personal loan, your repayment can also be auto deducted with Bureau Angkasa or savings deduction. The maximum Bureau Angkasa salary deduction is only 60% of gross income.

Interest Rates

Bank Rakyat Personal Financing-i offers choices of Fixed or Variable interest rates. The table below presents the latest interest rates from Bank Rakyat. A borrower that chooses Fixed rate can enjoy up to 3.30% interest with Takaful protection. While floating rate will be based on BFR and adjustment from Bank Rakyat. As this loan is Syariah compliant, there will be a ceiling rate where borrowers will be protected in case interest rates increase.

Fees

- There are no processing fees or extra for for application of this personal loan.

- There is a RM30 Wakalah fees

- There will be a 0.4% Stamp duty charge while 1% p.a for late repayment.

Eligibility

You will need to have at least RM 1000 of monthly salary with minimum 6 months of service to qualify for the loan. Only Malaysia citizens anywhere from 18 years old to a maximum for 60 years old at the end of financing tenure can apply for this loan. This loan is only offered to public sector and selected GLS’s in Malaysia with a minimum salary RM 1,000. The eligibility requirement for this loan is lower than private loan as salary is already auto deducted from Biro Angkasa.

Documents

- Photocopy IC ( front & back)

- Most recent 3 months income statement

- Most recent 3 months bank statement ( Wage account)

- Employment confirmation letter.

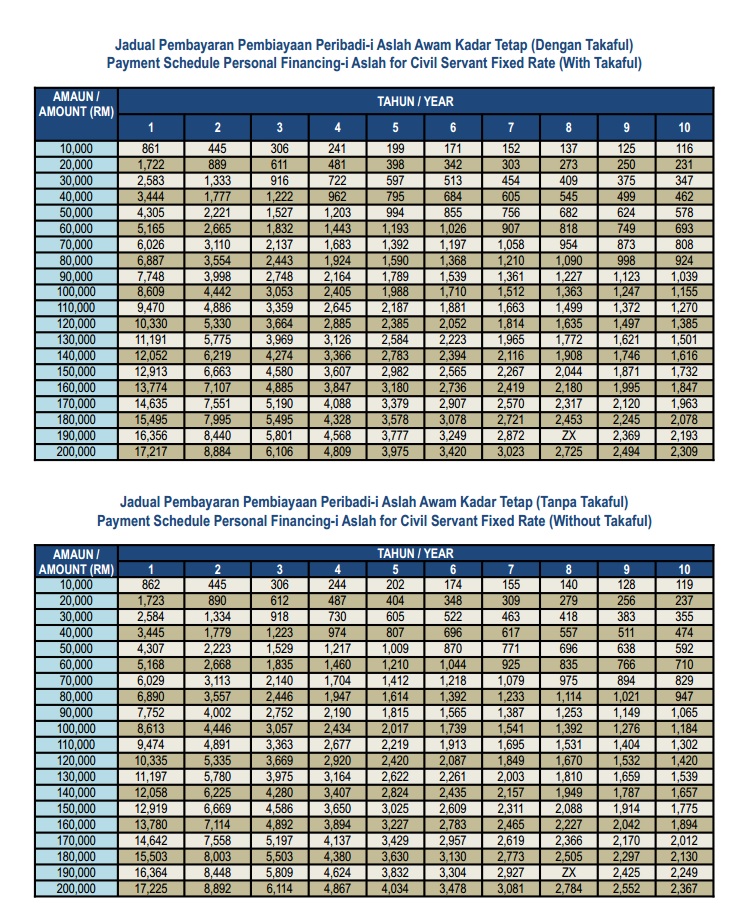

Repayment Table

Review

This loan is catered mainly for public sectors which means that it is impossible for anyone else from other sector to apply. Repayment is done via auto salary deduction.