UOB and OBCB Malaysia increase their BR (Base Rates) and BLR(Base Lending Rate) as of January 2016. The move is expected to have minor impact of loan repayments that is pegged with BR and BLR. This is also seen to reduce the competition from foreign banks in Malaysia as consumer is expected to borrow from banks who are offering cheaper loans. At the moment, there are not indication of major BLR or BR increase from local banks. There are also no indication of OPR( Overnight Policy Rate) from Bank Negara Malaysia.

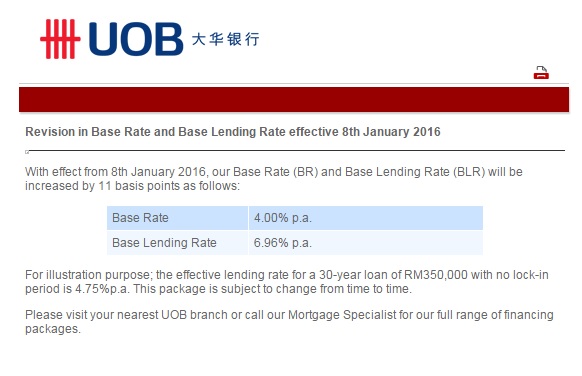

The announcement was made on UOB Malaysia website

UOB

UOB has revised it’s BLR and BR by 11 basis points to 4% Base rate and 6.92% BLR effectively on 2 January

OCBC

OCBC Bank Malaysia has also increased its interest rates by 7 basis points to 3.99% for BR and to 6.92% for BLR effective 2 Jan 16

Rise of BLR or BR

Banks actually have the flexibility to adjust their BLR which is based on OPR that is set by Bank Negara Malaysia although BLR and BR are rarely adjusted without changes from OPR.

BLR and BR increase will have impacts on flexible repayment loan such as home loans. Any increase of Base Rate or Base Lending Rate will have big impacts on overall interest payment although the impact may be small on a monthly basis. Ongoing fixed interest loan are immune to such increase although there are also disadvantages of such loans as interest may go down in the future.