| Personal Financing-i , Pinjaman Peribadi Ambank untuk kakitangan awam dan swasta |

|---|

| Interest as low as 4.30% to 4.80% p.a (Public Sector ) , 6.90% (Private Sector) |

| No guarantor needed and immediate approval |

| Only available for government servants, GLC staffs and selected private companies. |

| From RM 5,000 to RM 200,000 financing |

| Minimum 2 years to maximum 10 years repayment |

| Minimum RM 1,500 of basic income |

| Goverment servants only |

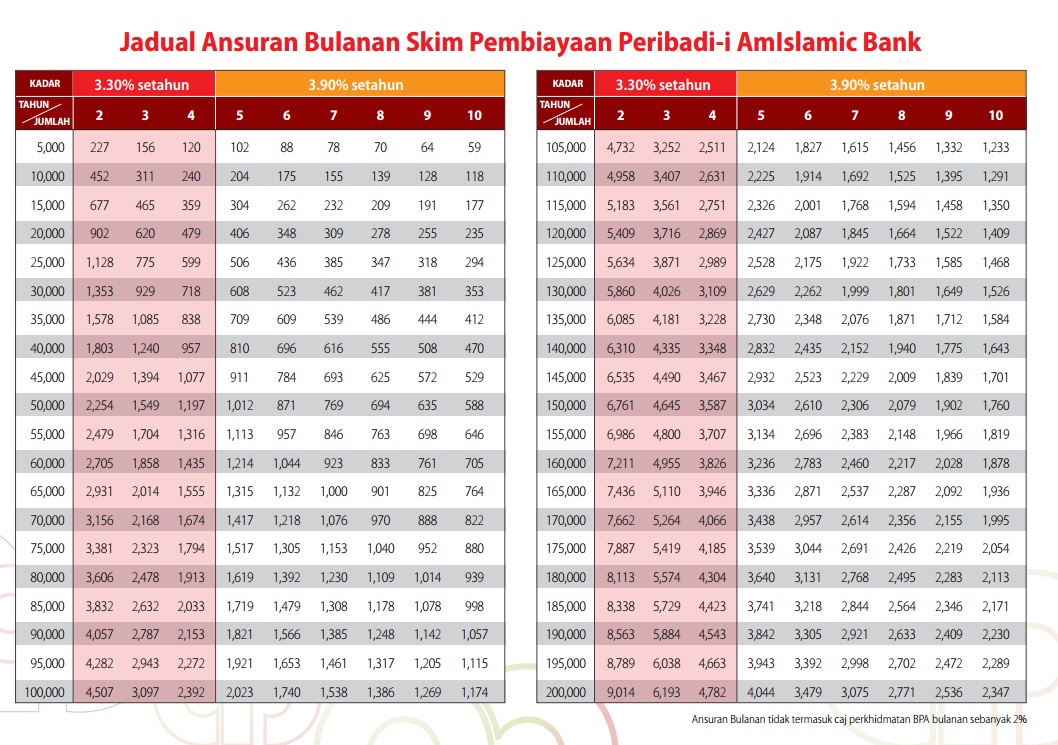

Ambank Personal Financing-i is a Shariah compliant personal loan that requires no collateral and guarantor. Personal Financing-i is based on Bai ‘ Inah islamic banking concept. As for public sector loan, Personal Financing feature a low 3.30% p.a flat rate loan, the effective rate of the loan would be 6.21% for 4 years while 6.95% for 10 years. This loan provides from RM 5,000 up to RM 200,000 financing with minimum of 2 years to a maximum of 10 years repayment which is also dependent on borrowers credit score. The amount that a person can borrow would also depends on his or her salary as the maximum deduction is only 60% of monthly salary.

As a government sector personal loan, the repayment of this loan will be done automatically via Biro Perkidmatan Angkasa (BPA). For a start, the first 3 months of the loan is delayed. This will give some financial room for cash strapped borrowers. This now is also available to private sector however you will need to be in the panel of private company list. Auto debit via Ambank account will be used for private sector repayment.

Upon approval, borrower is required to open an Ambank account. The loan amount will be disburse to borrower’s Ambank account.

Fees

A 4% processing fees is chargeable from the financing amount. Takaful insurance coverage is required for this loan. A standard 0.5% stamping fees based on loan amount will be deducted from the loan. No early settlement fees is required.

Eligibility

This is a public sector loan which is only available to government staffs. Among those qualifies are employee of Federal, State Government, Local councils and selected list of private panel company. A borrower will need to be minimum 18 years old while should not be over 60 years at the end of loan tenure. A basic income of RM 1,500 is is required while minimum 3 months employment

Documents

- 3 Copies of Police, Armed Forces or Civilian IC ( Must be certified by head of department )

- 3 Copies of most recent 3 month salary statement( Must be certified by head of department )

- Bank statement of salary credit account

Repayment Table