| HSBC Amanah Personal Financing-i |

|---|

| 10.5% to 12.5% (flat rate ) p.a |

| Minimum of RM 6,000 to maximum of RM 150,000 financing. |

| From 2 years to maximum of 7 years repayment |

| For single applicant from 21 to 55 years of age |

| Open to any Malaysian citizens and Permanent Residents only. |

| Minimum income of RM 36,000 p.a. ( RM 3,000 per month) |

| Minimum repayment starting RM134.00 |

HSBC Amanah Personal Financing-i is a Shariah compliant personal loan that is based on Murabahah concept from HSBC. Although being Shariah Islamic Based, this loan is open to all races and religions. This personal loan requires no collateral and guarantor. This loan features a minimum 10.5% p.a flat interest rates and a 2 to 5 years maximum repayment period. One can borrow a maximum of RM 150,000. The achievable minimum sum of repayment monthly would be RM 134 at RM 6,000 financing and 7 years repayment.

Interest Rates

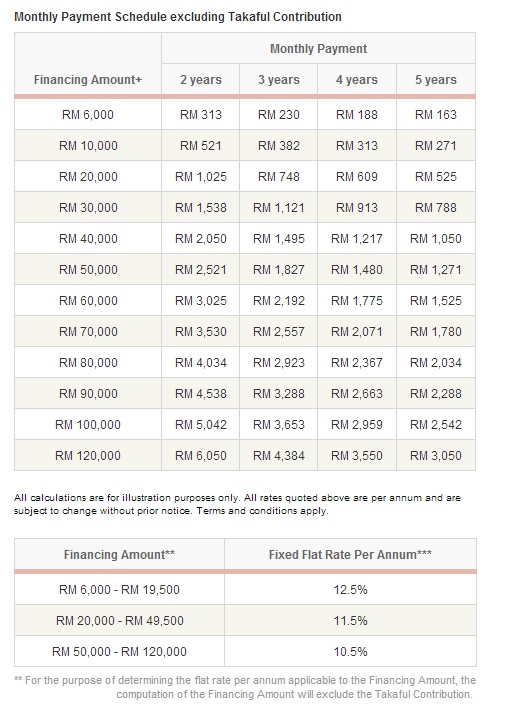

Interest rates varies from 10.5% to 12.5% p.a. The rates you can enjoy would be based on loan amount.

At the time of writing, this personal loan interest rates do not seems attractive enough compared to what is offered by other Malaysian banks. As a rule of thumb, you will be able to enjoy lower interest rates with higher amount loan. This features a fast approval rate (within 1 day) with a 3 days cash disbursement. The loan amount will be disbursed to borrower’s HSBC account. A borrower may need to open a HSBC account upon his or her loan approval.

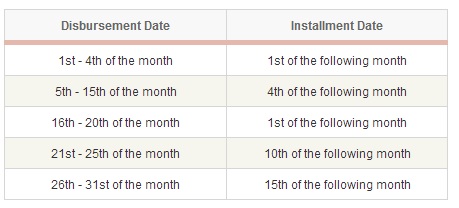

Repayment for this loan is done with standing instructions from the borrower’s HSBC account. The first installment of the loan would vary depending on disbursement cash date.

Fees

There are no processing charges and stamping fees for this loan. There are no early settlement fees for the loan however 1 month written notice has to be given to HSBC prior to the settlement. There is a 1% p.a. penalty for late repayment. Takaful insurance is compulsory with the loan.

Eligibility

This personal loan is open to Malaysian citizens and Permanent Residents (PR) only. So foreigners with PR status can also apply for the personal financing. You must be 21 years old to 60 years at the end of loan tenure. The minimum montly income requirement for this loan would be RM 3,000.

Documentation

Employed

- Photocopy MyKad (front and back)

- Most recent 3 months payslip and bank statement ( salary credit)

- Most recent EA form and EPF statement

Self Employed

- Photocopy MyKad (front and back)

- Most recent 3 months

- Most recent Form B with LHDN income tax payment receipt

- EPF statement audited profit and loss statement

Repayment Table

Hsbc personal loan repayment table

Pros

- Fast approval

- This loan is also available to Malaysian permanent residents and foreigners

Cons

- 10.5% p.a flat rate which translates to as high as 20% effective rates