The prime minister Datuk Seri Najib Tun Razak had recently announced the RM 50 million of Graduate Entrepreneurship Fund as part of 2014 budget. The purpose of this allocation to boost the support for SME and encourage entrepreneurship in Malaysia. This loan will be managed by SME bank which will provide loans up to RM 500,000 at 4% p.a. interest rates.

This is quite an opportunity to for graduate to setup businesses or for SME to fund their businesses. Not much information has been released yet about this loan however we estimated that will be rather the same as the existing Graduate Entrepreneur Fund (TUS) that was setup during the 9th Malaysia plan to help encourage entreperneurship.

Here are some details of Graduate Entrepreneur Fund (TUS)

| Graduate Entrepreneur Fund (TUS) |

|---|

| Open to private sectors |

| Interest of 4.0% montly rest |

| Maximum financing amount of RM 500,00 |

| Maximum financing period of 10 years, buildings premises 20 years |

The interest rates of TUS is calculated at 4.0% p.a. monthly rest.This is a very good rate as with monthly rest, the effective interest rate is as good as 4.0% p.a

For a start, this loan is open to all Malaysian citizens holding a minimum cerfication of Diploma that is recognizable by MQA. You must be at most 15 years from graduation date.

To apply for the loan, you will first need to prepare and submit your business plan to the nearest SME Bank branch. If you are a graduate who have no prior business experience, you will need to attend a mandatory ISKEN training where you will need to submit 5 business proposal at the end of the course. This will determine whether you are eligible for the loan. If you have been in business for 2 years, ISKEN training will not be needed.

Overall, Graduate Entrepreneur Fund seems like a cost effective way to start your own business compared to other loans in Malaysia.

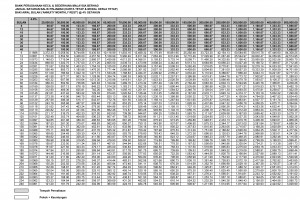

The repayment table for Graduate Entrepreneur Fund (TUS) is available below