| Public Bank BAE Personal Financing-i , Pinjaman Peribadi Public Bank BAE |

|---|

| Only available for employee of selected government agencies with minimum 1 year employment |

| 2 to 5 years 3.40 % p.a. flat rate |

| 4 to 10 years 4.88 % p.a. flat rate |

| From RM 5,000 up to RM 150,000 financing available |

| Repayment from 2 to 10 years |

| Age requirement of 20 years to 60 years old |

| Minimum annual income of RM 18,000.00 around RM 1,500 per month |

Pubic Bank’s BEA Personal Financing-i is only available for selected panel of public sector employee. You must be employee of the Government and State Government sector to be able to apply for the loan. Staffs from Government agencies such as LHDN, Mara and selected listed GLC are also eligible for the loan.

For a start, Public Bank BAE is fully Shariah compliant financing product that is unsecured which requires not collateral and guarantor. This personal loan offers a competitive interest rates which will depends very much on tenure of the personal loan. You can enjoy up to 3.40% p.a when your repayment period is 2 to 5 years while 4.88% p.a. flat rate when your repayment is 4 to 10 years. The interest rates are competitive as loan repayment is guaranteed under auto salary deduction. This loan may take a few days for approval. Upon approval, the funds will be transferred to the account stated in borrower’s loan application form.

Repayment

As of all public sector loan, the repayment of this loan is done by salary deduction while the maximum auto deduction is only less than 60%. Biro Angkasa is compulsory with the loan. This way is more convenient for loan repayment.

Fees

There will be a RM 100 processing fees and a 0.5% stamp duty based on amount loaned. Takaful insurance is not compulsory but encouraged with the loan. As a Shariah compliant loan, there are no early settlement penalty for the loan. A standard 1% p.a penalty will be charge for late repayment.

Eligibility

Public Bank BAE Personal Financing is not a private sector loan which is only available to Goverment sector employees from State or Federal Levels and selected GLCs only. Applicants will have to be minimum 20 years old while not exceeding 60 years of age at the end of loan tenure. The minimum income for loan application would be RM 3,000 per month. Applicants will also need to have a minimum 2 years employment with relevant agency before applying for the loan. If you are an existing Public Bank customer with good credits with Public Bank, you can try applying for Plus BAE Financing-i.

Documents

Documents required for loan application

- Photocopy IC ( Front & Back)

- Latest 3 months payslip or latest EA statement

- Latest EPF statement or employment offer letter

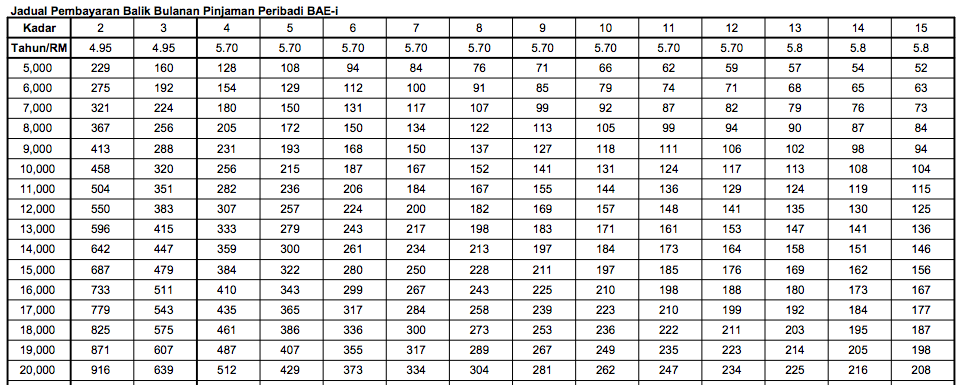

Repayment Table