CIMB Cash Plus Personal Loan |

|---|

| Published rate of 5.88% promo (effective is much higher) or -14.88 p.a , effective interest rates ranges from 10.65% to 24.51% p.a |

| Maximum 8 times of gross income (Maximum RM 100,000 financing) |

| Minimum 6 months to maximum 5 years of repayment |

| For single applicant from 21 to 58 years of age |

| Minimum requirement of RM 2,000 of basic income |

| Malaysian Citizens only |

CIMB Cash Plus is one of the popular personal loan from CIMB Bank. This loan requires no guarantor nor collateral however there is only a maximum 5 years of repayment period. Cimb Cash Plus offers RM 2,000 to a maximum of RM 100,000 financing. The flat interest rates will depends on the loan amount which starts from 13.38% to as low as 6.88%. At 13.38% Flat rate, the effective rate of this loan is 23.39% p.a.

Interest Rates

Salaried RM 2,000 – RM 20,000 14.66% Flat , 24% Effective

Salaried RM 20,000 – RM 50,000 10.88% Flat, 18.62% Effective

Salaried RM 50,000 – RM 100,000 8.20% Flat, 14.50% Effective

Self Employed RM 2,000 – RM 100,000 14.66% Flat, 24% Effective

A borrower can enjoy from RM 2,000 up to RM 100,000 of financing. Do take note that the maximum that someone can borrow would depends on their monthly gross income and the amount borrowed. General rule of thumb is that you can enjoy better rates with higher financing amount. Self employed will have to pay high interest rates. The maximum amount of this loan would be 8 times gross monthly income make this one of the highest amount that you can borrow with respect to your salary in Malaysia. The amount would also be subjected to credit ratings.

Fees and Charges

There are no processing fees for this loan. However a 0.5% Stamp Duty is applicable. CIMB will impose 1% p.a. penalty for any late repayment of the loan. There are no early settlement fees for the loan. Applicant will have to give the bank 1 month notice before early settlement of the loan.

Cash Plus Assurance

Taking up an Insurance is required for this loan. The fees of the insurance would depends on factors such as loan amount, age and tenure of the loan. The insurance is underwritten by Sun Life Malaysia Assurance Berhad. In the event of borrower’s death before the financing tenure, Bank shall waive the obligation for borrower to pay up to RM 25,000.

Eligibility

To qualify for the loan, you must be a Malaysian Citizen aged from 21 to 58 years old and the end of loan tenure with a minimum of RM 2,000 basic monthly income.

Documents

Employed

- Photocopy IC (Front & Back)

- 3 months most recent income slip

- Most recent bank statement of salary credit account

Self Employed

- Photocopy IC (Front & Back)

- Business registration form

- 6 months most recent bank statement

- Most recent income tax return form

- Most recent P&L statement

Commission Earners

- 6 months commissions statement with bank transaction of the payment

- Most recent B form with LHDN payment statement.

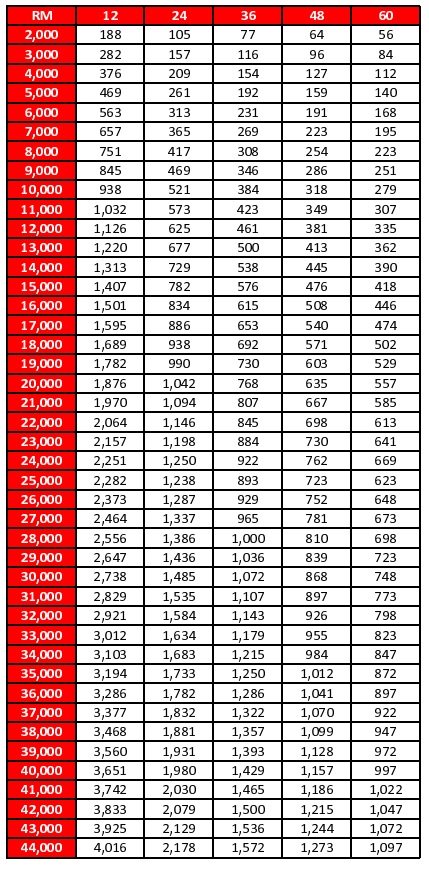

Cash Plus installment repayment table can be found on the link below

Pros

- You get 100% cash disbursement as to what you applied

- Bundled Insurance plans

- Claim to have 24 hours approval process

Cons

- N/A