Property prices in Malaysia increased tremendously since the end of 2009. Areas in Klang Valley have seen property costing double the price compared to few years back. The sentiments are really positive for investors and everyone is rushing to get a piece of the action but is this really sustainable ?

Property prices in Malaysia increased tremendously since the end of 2009. Areas in Klang Valley have seen property costing double the price compared to few years back. The sentiments are really positive for investors and everyone is rushing to get a piece of the action but is this really sustainable ?

Rise of the planet of the properties

No doubt properties price are always on the rise. It has always been a slow steady rise since the 90s. However prices have suddenly surged exponentially since 2009. Here are some of the reasons that caused this

Cheap Credits

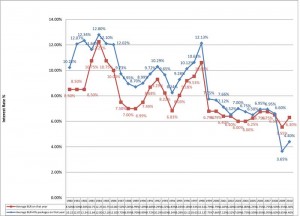

The government has been encouraging home ownership ever since the end of 1997 financial crisis. BLR has been low since 2009 at 5.5% to encourage home ownership and boost local consumption. This works pretty well as developer keeps building units and sells more which is turn reflects a healthy yearly GDP growth.

China

As Malaysian biggest trading partner, China also plays a very important role driving up regional property prices. Since the 2008 US financial crisis, the Chinese government had injected 4 trillion as part of plan to stimulate the economy to counter weak export. Part of these money were used to develop new cities ,infrastructure and buildings. The stimulus also created a lot of wealth in the market. House buying has been considered one of the safest investment all time by traditional Chinese. Rich and middle class chinese have been investing heavily on properties domestically and globally. This has created a lot of demands for raw material thus driving up the prices of raw materials for properties globally.

Is Malaysian property heading towards a bubble ?

The answer is yes, prices of properties are currently out of reach by many new home buyers and businesses. Many have resorted to lengthen their loan albeit being capped by Bank Negara to 35 years. In certain areas in Klang Valley there are signs of empty units all over that is waiting for it’s buyer. Seller are not willing to rent because they can make good profit as property price is rising exponentially.

Will the bubble burst ?

There are many factors that have to be taken into consideration if the bubble will burst.

Interest rates

Malaysians have been enjoying good interest rates for home mortgages. Coupled with low entry cost to buy a house, property speculators are able to utilize this rate to buy multiple units of properties. While Bank Negara stated that the BLR will remain the same until end of 2013, interest rates do fluctuate from time to time. Weak Ringgit and slow economy may cause the rise of interest rates. As of time, Bank Negara will probably try to maintain a low BLR to prevent a burst that may trigger a 2008 American style sub prime crisis.

Household debts

Malaysians do have one of the highest household debts in Asia. Only second to South Koreans. Our household debt is 83% of the GDP (gross domestic product) as of 2013. What does it means ? On average , Malaysians will spend 83% of their salary servicing loans while having 17% to survive the entire month. The main drive of high household debts is of course home loan. Malaysians owe a total of RM316.2 billions in home loan. This is not healthy as any spike on the economy may cause financial strains and perhaps a mass default.

China

Yet again, Malaysian biggest trading partner. Chinese citizens have been buying properties like there is no tomorrow. There are vast empty cities in China with all it’s properties sold without real tenants. Just do a Google search for “Ghost city china” , anyone can find dozens on information about this issue. Chinese government may be able to provide more stimulus to the economy but can this remain forever ?

Chinese Ghost City